Understanding Bitcoin Halving and How to Profit from It

Bitcoin, the pioneer of the cryptocurrency world, has captivated the imaginations of investors, traders, and enthusiasts alike since its inception in 2009. Among the intriguing features of Bitcoin’s architecture, the phenomenon known as “Bitcoin halving” stands out.

In this comprehensive guide, we will explore the concept of Bitcoin halving, its significance, and the strategies for potentially profiting from it. Additionally, we will delve into current trends in the Bitcoin market to help you make informed decisions.

Understanding Bitcoin Halving

Bitcoin halving, commonly referred to as the “halvening,” constitutes a pivotal event in the Bitcoin network that occurs roughly every four years or after 210,000 blocks have been mined. During this event, the rate at which new Bitcoins are created is reduced by 50%. In essence, miners, who validate transactions and secure the network, receive half the reward they previously did.

The Significance of Bitcoin Halving

- Controlled Supply: Bitcoin halving is at the core of the cryptocurrency’s monetary policy, which aims to cap the total supply at 21 million coins. This inherent scarcity plays a pivotal role in bolstering Bitcoin’s value proposition, distinguishing it from fiat currencies susceptible to inflation.

- Mining Incentives: Halving events serve as a balancing mechanism for the economic incentives of Bitcoin miners. The reduced reward incentivizes miners to enhance their efficiency and invest in superior hardware. It also ensures the gradual introduction of new Bitcoins into circulation, mitigating the risk of excessive inflation.

- Market Sentiment: Historically, Bitcoin halving has been a catalyst for enthusiasm and optimism within the crypto community. Anticipation of the event often leads to increased demand and, consequently, upward price movements, though this outcome is not guaranteed.

How to Profit from Bitcoin Halving

- HODLing: One of the most straightforward strategies for potentially profiting from Bitcoin halving is to hold onto your existing Bitcoin holdings. As the supply diminishes and demand remains robust, the price may experience appreciation over time, affording you the opportunity to sell your Bitcoin at a higher valuation.

- Trading: Active traders can leverage the heightened volatility and price fluctuations that frequently accompany Bitcoin halving events. By accurately forecasting market movements, traders can buy low and sell high, maximizing their potential profits. Nevertheless, successful trading demands knowledge, experience, and adept risk management.

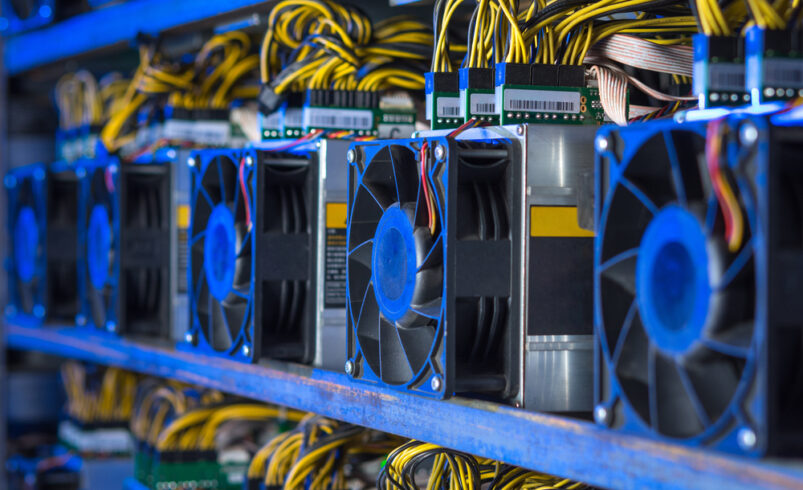

- Mining: While Bitcoin mining has grown increasingly competitive and resource-intensive, some individuals and entities still find it profitable. Mining operations equipped with efficient hardware and low electricity costs can continue to secure the network and receive Bitcoins for their efforts.

- Investing in Mining Ventures: Another indirect approach to profit from Bitcoin halving is by investing in mining companies. As the miner’s reward decreases, well-established and efficient mining operations may become more lucrative. Investing in such companies provides exposure to the potential profitability of mining without the complexities of operational management.

- Staking: Although Bitcoin does not support staking, some cryptocurrencies, like certain proof-of-stake (PoS) coins, offer staking rewards as an alternative to mining. Staking entails holding and locking a specified amount of cryptocurrency in a wallet to support network operations and earn rewards. Exploring staking opportunities in other blockchain projects can be an avenue to consider.

Current Bitcoin Trends

As of this press, several noteworthy trends have emerged within the Bitcoin ecosystem:

- Institutional Adoption: Institutional investors, including major corporations and financial institutions, have displayed increasing interest in Bitcoin as an asset class. Companies like Tesla and Square have incorporated Bitcoin into their balance sheets, and investment firms have introduced Bitcoin-focused products such as exchange-traded funds (ETFs).

- Regulatory Landscape: Governments and regulatory bodies worldwide have been working to define and implement cryptocurrency regulations. Clearer regulatory guidelines can offer greater certainty to investors and may encourage mainstream adoption.

- DeFi and NFTs: The ascent of decentralized finance (DeFi) and non-fungible tokens (NFTs) has broadened the utility of blockchain technology beyond mere digital currency. These innovations have attracted significant attention and investment in the crypto sphere.

- Scaling Solutions: Bitcoin’s scalability challenges, leading to high transaction fees during periods of peak demand, have prompted the development of layer-2 solutions like the Lightning Network and Taproot. These initiatives aim to enhance Bitcoin’s usability.

- Environmental Considerations: Concerns about Bitcoin’s energy consumption, particularly in mining, have raised environmental questions. Efforts are underway to make Bitcoin mining more environmentally sustainable, including the use of renewable energy sources.

Conclusion

Bitcoin halving is a momentous event with far-reaching implications for the cryptocurrency’s supply, mining incentives, and market sentiment. Gaining a comprehensive understanding of its significance can empower you to make informed choices on how to potentially profit from it.

Whether you choose to HODL, trade, mine, invest in mining companies, or explore other avenues, conducting thorough research and staying attuned to the evolving trends and developments in the Bitcoin ecosystem are vital. In a cryptocurrency market that continues to evolve, knowledge and adaptability are key to your success as a Bitcoin investor or participant.

DISCLAIMER: It's essential to understand that the articles on this site are not meant to serve as, nor should it be construed as, advice in legal, tax, investment, financial, or any other professional context. You should only invest an amount that you are prepared to lose, and it's advisable to consult with an independent financial expert if you're uncertain. To obtain more information, kindly examine the terms of service and the assistance and support resources made available by the issuing or advertising entity. Our website is committed to delivering accurate and unbiased news, yet it's important to note that market conditions may change rapidly. Also, be aware that some (but not all) articles on our site are compensated or sponsored.